Fraud Museum Game: Shining a Light on Fraud (Giveaway)

/Sponsored by Fraud Magazine

Made up of artifacts, memorabilia, documents and other pieces of fraud history collected by ACFE founder and Chairman Dr. Joseph T. Wells, CFE, CPA, this year’s Fraud Museum game shines a light on some of fraud’s most infamous schemes.

To participate in this year’s game, read the quiz questions below and provide your answers for all four on Twitter using the hashtag #fraudconf to be entered for your chance to win a $250 gift card. The game begins on Monday, June 22 and will close at 11:59 p.m. Central Time on Wednesday, June 24. Only conference attendees may participate and the official rules can be found here. The winner will be notified via email and will be announced in the Conference Recap newsletter on Monday, June 29.

Quiz Questions

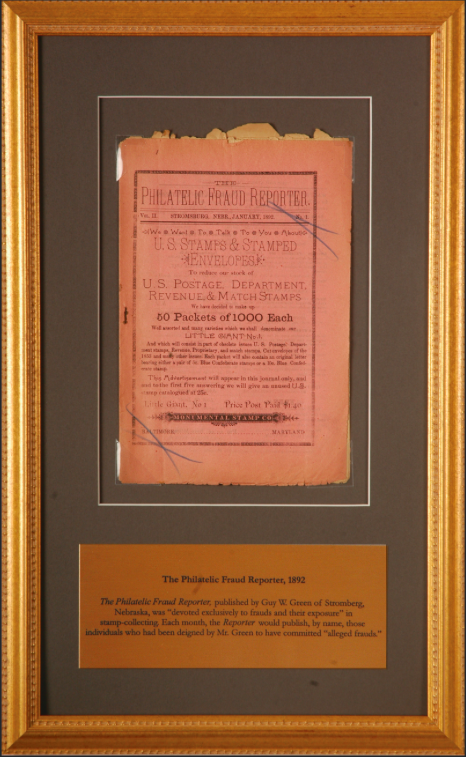

This Fraud Museum artifact from 1892 was published by Guy W. Green and was “devoted exclusively to frauds and their exposure.”

Along with Enron and WorldCom, this company, whose stock certificate is included below, was one of the largest accounting frauds of the early 21st Century.

We include three magazine covers in this year’s gallery. Which magazine covers shocking cases of consumer fraud?

The French Letter, 1876, is a simple scheme that shows the reuse of what item?

This U.K. Publication tells the story of “The Guinness Four,” top executives of the venerable Irish brewer, who were convicted in a conspiracy to fraudulently drive up the price of the company’s shares during a 1986 take-over battle for a British distillery. The central figure was former Guinness chairman Ernest Saunders, whose downfall began after the arrest of legendary inside trader Ivan Boesky, who informed on Saunders in a plea agreement with U.S. officials.

The trial of the four men in 1990 was the longest (112 days) and the most expensive (₤7.5 million) legal battle in British history. Saunders received the harshest prison sentence, five years, but was released in only ten months after begin diagnosed with “dementia.” Mysteriously, Saunders quickly recovered from his “disease” and retired to a life of obscurity.

An attempt was made to mail this letter from Belfort to Tournus, France on June 17, 1876 with a previously used stamp. Before its delivery, the document was intercepted by the French Postal authorities, who noted in pencil, “timbre réuitilisé, Fraude” (stamp reused, fraud).

Author Clifford Irving pulled off what many called “the con of the [20th] century” by writing a book entitled The Autobiography of Howard Hughes, published in 1971. The legendary billionaire Hughes had become a total recluse by 1958 and from then on, had refused media interviews or public contact of any kind.

Irving, who had already written several well-regarded books, approached his publisher, McGraw-Hill, and presented them with a letter purportedly written in hand by Hughes authorizing Irving to write his autobiography and stating that Hughes would cooperate by providing exclusive interviews to Irving. The publisher jumped at the chance, providing $765,000 in advances, $100,000 to the author and the remainder to Hughes. The letter and book were complete fakes; Irving later admitted that he had never met or even talked to Hughes.

The endorsement for the $665,000 check payable to Hughes was forged by Irving’s wife and deposited into a Swiss bank account. The scheme came to light when Hughes finally had a telephone conference call with the publishers denouncing the book. Irving repaid the entire advances to McGraw-Hill and served 14 months in prison. Hughes died in 1976.

This was the second and last edition of Frauds and Rackets magazine. According to publisher Jules Warshaw, readers of the first issue “…were rooting for the success of this bold, new concept in publishing.” And while the magazine railed against various corporate crimes, it also accepted paid advertising from a number of dubious products, such as a “miracle” hair re-growth tonic, a “gasoline atomizer” to double fuel mileage, and an electric “spot reducer” to shed unwanted fat, all of which were subsequently exposed as frauds.

The Philatelic Fraud Reporter, published by Guy W. Green of Stromberg, Nebraska, was “devoted exclusively to frauds and their exposure” in stamp-collecting. Each month, the Reporter would publish, by name, those individuals who had been deigned by Mr. Green to have committed "alleged frauds."

The energy giant that eventually became known as Enron was founded in 1930, but it collapsed completely in 2002 because of a massive accounting fraud. Experts cannot even agree on the total amount, but the cost of the fraud is estimated to exceed $30 billion. The most disturbing result was the human tragedy was tens of thousands of people lost their jobs and their retirement savings.

Adelphia Corporation was founded in 1972 by John Rigas and quickly became one of the nation’s largest providers of cable television services. However, according to prosecutors, Rigas and his family used the public company as their “private piggy bank,” looting the organization of hundreds of millions of dollars and causing shareholder losses of more than $60 billion. In 2005, Rigas, his two sons, and two other executives were sentenced on several fraud charges to lengthy prison terms.

Along with Enron and WorldCom, Rite Aid was one of the largest accounting frauds of the early 21st Century. The drug store chain overstated its income by $1.6 billion in 2000. Former CEO Martin L. Grass, CFO Franklyn M. Bergonzi, Vice President Eric L. Sorkin and Chief Counsel Franklin Brown all received lengthy prison sentences.

![Author Clifford Irving pulled off what many called “the con of the [20th] century” by writing a book entitled The Autobiography of Howard Hughes, published in 1971. The legendary billionaire Hughes had become a total recluse by 1958 and from then on…](https://images.squarespace-cdn.com/content/v1/51533cfce4b0e8635a163f97/1592755628024-Y4FEKR1YI148M5HOEB8O/time+magazine+cover.png)